what is an example of an ad valorem tax

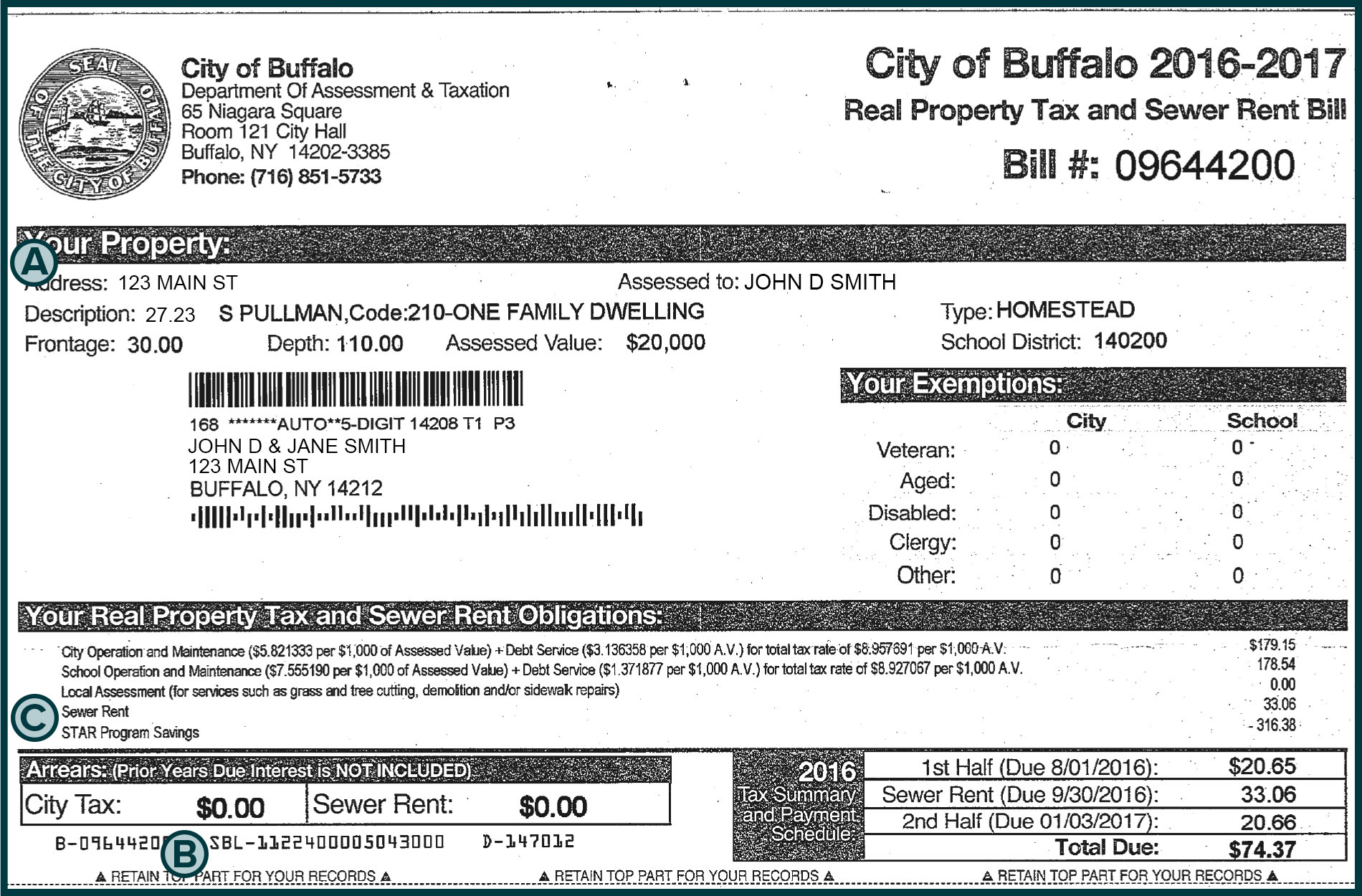

Ad Valorem Tax. The most common ad valorem tax examples include property taxes on real.

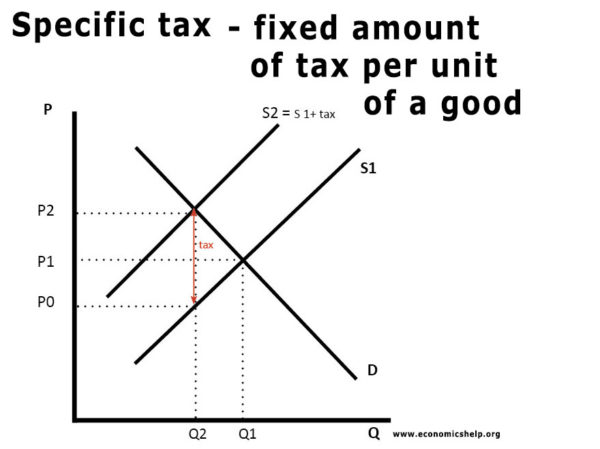

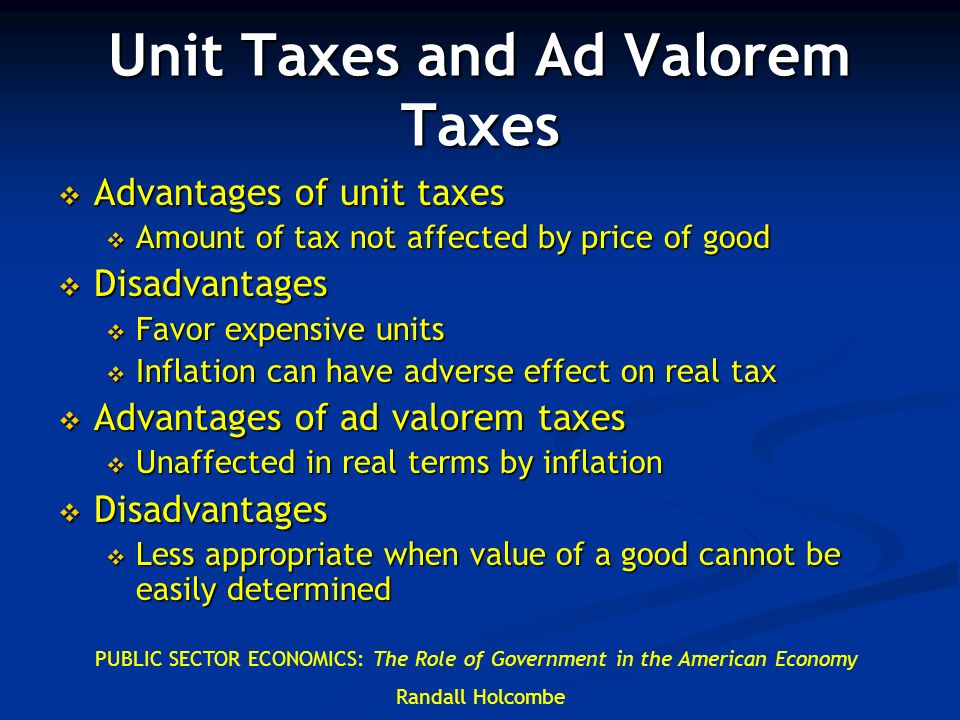

Excise Taxes Unit Taxes Ad Valorem Taxes Ppt Video Online Download

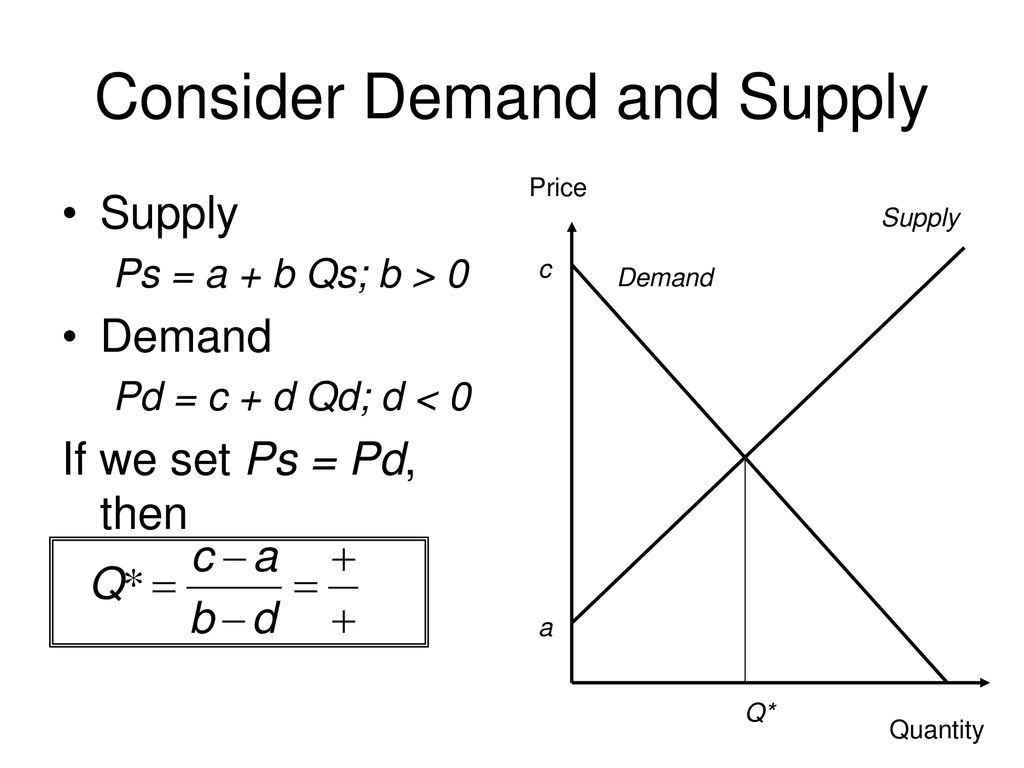

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

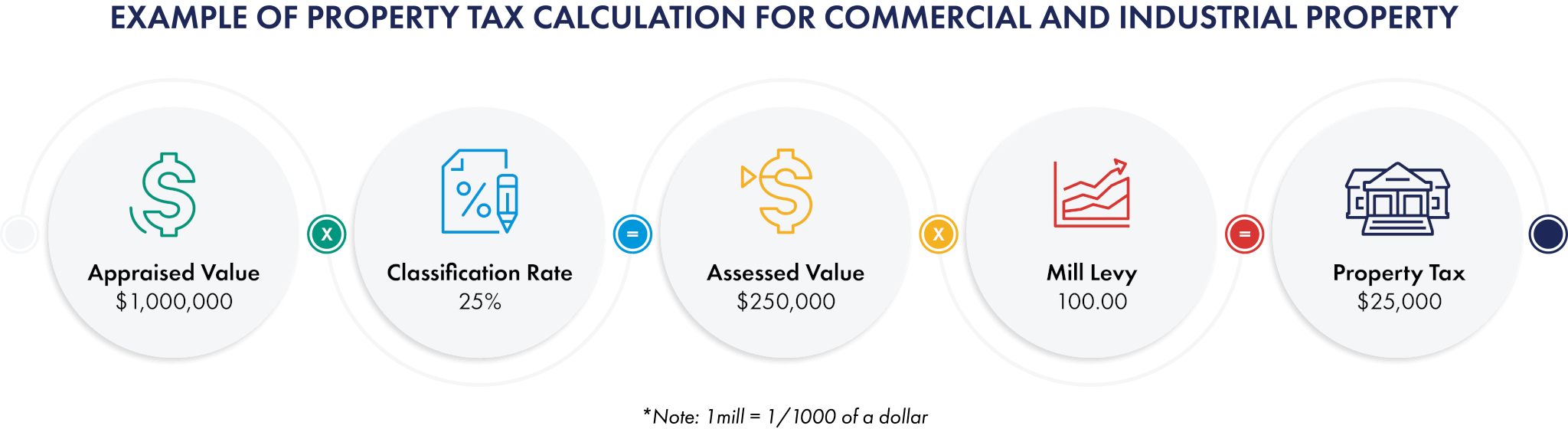

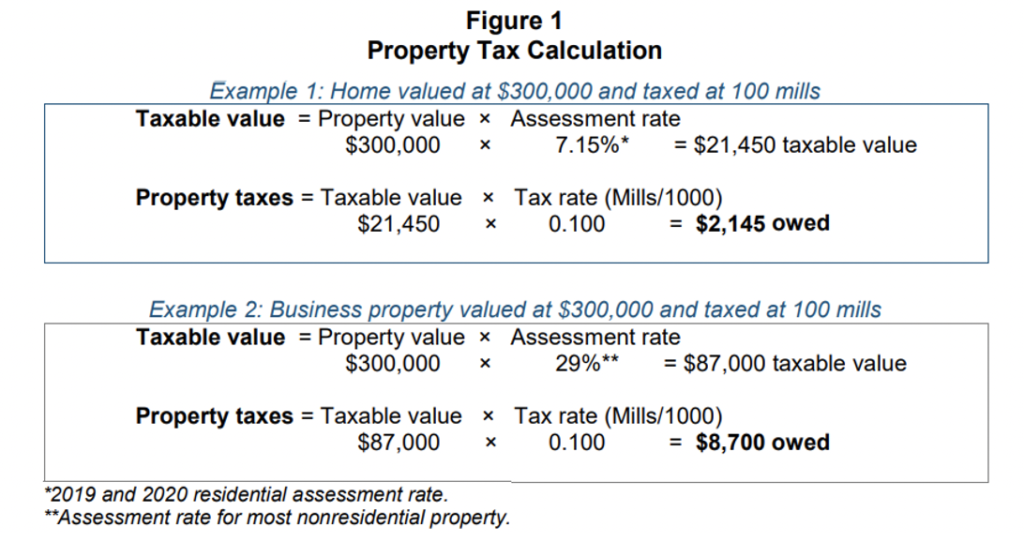

. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. This is determined by multiplying the market value times the corresponding Property Classification. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

Mar 3 2022 4 min read. An ad valorem tax allows to easily adjusting the amount to be paid in any given occasion. The most common ad valorem tax examples include property taxes on real.

In a nutshell ad valorem tax is a type of tax that is charged on property according to the propertys value. Ad valorem tax is a common form of taxation on real property such as. For example VAT is charged at a rate of 20 in the UK.

The most common ad valorem taxes are property. The most common ad valorem tax. Ad valorem tax examples.

For another example lets say the property taxes on a home come to. Local government entities may levy an ad valorem tax on. Ad valorem taxes comprise many of the state and local taxes in the US as well as a variety of taxes charged abroad.

Property tax is a form of ad valorem tax levied on the value of the real estate or other residential and commercial properties paid by the. What is subject to ad valorem tax. How does Ad Valorem Tax work.

If the market value of a 2000-square foot home is 100000 the ad valorem property tax is based solely on the homes value regardless of its relative physical size. An ad valorem tax is a tax that is based on the assessed value of a property product or service. An ad valorem tax is expressed as a percentage.

Real property is subject to ad valorem tax. An ad valorem tax is a tax that is based on the assessed value of a property product or service. An ad valorem tax is a tax that is based on the assessed value of a property product or service.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. This includes land buildings other structures and any improvements to the property such as a. Ad valorem Latin for according to the value taxes are levied solely as a percentage of a propertys market value without regard to quantity.

Imports are charged 8 exports 1 ad valorem duty. Assessors calculate these taxes on 1st of January of every year. 3 Examples of Ad Valorem Taxes.

Ad valorem tax meaning is representative of a percentage of the assessed value of a property. Ad valorem tax example. However ad valorem taxes have the disadvantage of imposing taxes regardless of the cost to the taxpayer.

An example of an Ad Valorem Tax. Which is an example of an ad valorem improvement. What is an example of an ad valorem tax is.

Definition and Examples of Ad Valorem Taxes. The most common ad valorem taxes are property taxes levied on. About 4000 were thus annually imported and an ad valorem duty was levied by the.

Ad Valorem taxes are calculated based on the vehicles assessed value. For example if this tax is applied to the value of a property every year the tax burden will increase. Ad valorem sentence example.

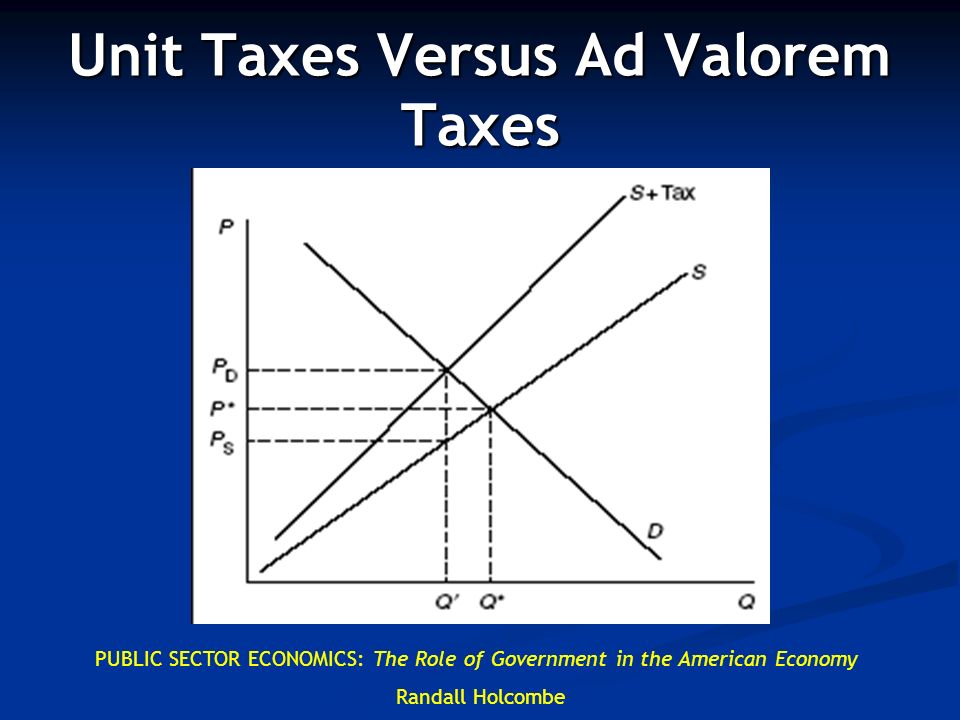

What is an example of an ad valorem tax is. A 20 ad valorem tax increases production costs by 20 at. The most common ad.

Excise Taxes Unit Taxes Ad Valorem Taxes Ppt Video Online Download

Incidence Of Ad Valorem Taxes Ppt Download

Ad Valorem Tax In Texas Texapedia The Encyclopedia Of Texas Civics

Kansas Property Tax Kansas Department Of Commerce

County Voters To Go To Polls For 6 Millad Valorem Tax

Broward County Property Taxes What You May Not Know

Difference Specific Vs Ad Valorem Tax On Monopoly Economics

Indirect Taxes Unit And Ad Valorem Taxes Economics Revision Youtube

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

:max_bytes(150000):strip_icc()/howhomevalueisassessed-f1f98b53f65943d8bda8304d43175cfa.png)

Learn How Property Taxes Are Calculated

Real Estate Property Tax Constitutional Tax Collector

The Effect Of A Tax On Supply Part 2 Youtube

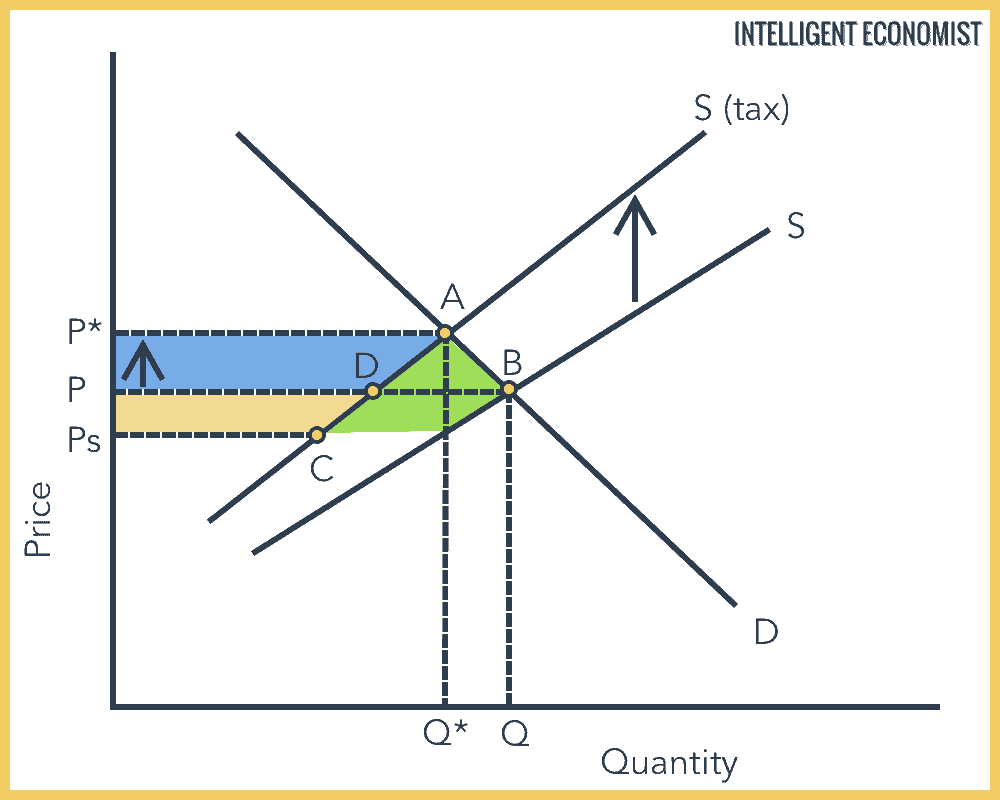

Indirect Tax Intelligent Economist

Understanding California S Property Taxes

Tax Rates Gordon County Government